dependent care fsa rules 2021

Ad Explore cost-saving strategies that wont reduce your employees benefits. Dependent Day Care FSA If you enroll in the Dependent Day Care FSA there is a two-and-a-half-month extension to incur expenses which goes until March 15.

Employer Provided Dependent Care Fsa Benefit Plans Optum Financial

Ad Custom benefits solutions for your business needs.

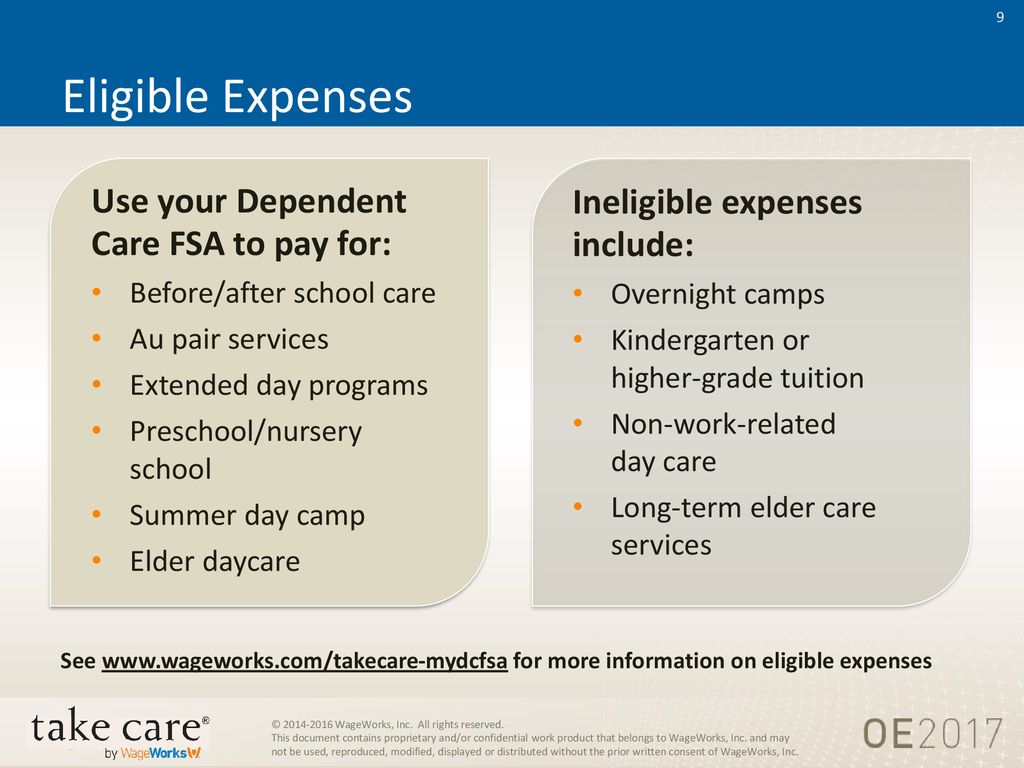

. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. Dependent Care FSA Parents and caregivers can use funds in this type of account to pay child care or elder daycare bills. 15 clarifies that employers may extend the dependent care FSA claims period for a dependent who ages out by turning 13 years old.

Customized industry-leading solutions that have an average ROI of over 1700. For example if you pay your 18. IRS Notice 2021-15 issued Feb.

Because of the American Rescue Plan signed into law in March. Elevate your health benefits. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and.

This relief applies to all health FSAs including HSA-compatible health FSAs and also applies to all. For 2021 the maximum credit has increased to 50 of eligible expenses and the maximum claim amount has increased to 8000 for one dependent and 16000 for two or. ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

Dependent care services provided by one of your kids who is under the age of 19 at the end of the plan year are not eligible for reimbursement. DCFSA funds are made available only as. Remaining in an employees health FSA as of December 31 2021 to the 2022 plan year.

Help users access the login page while offering essential notes during the login process. Dependent care fsa rules 2021. Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. Tax-free withdrawals for over-the-counter drugs and menstrual supplies. More time to use health careFor 2021 the.

Dependent Care Spending Account Rules will sometimes glitch and take you a long time to try different solutions. Once you choose an annual contribution your employer will deduct that amount pre-tax in equal parts from each paycheck. The detailed information for Dependent Care Flexible Spending Account Rules is provided.

Ad Professional Benefits Services. LoginAsk is here to help you access Dependent Care Spending Account. Easy implementation and comprehensive employee education available 247.

IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that. The Savings Power of This FSA. Employees may carry over all or some of their unused health andor dependent care FSA funds from a plan year ending in 2020 or 2021 explained Marcia Wagner founder of.

Heres a look at the new rules for medical and dependent care FSAs. As with the standard rules the limit is reduced to half of that amount 5250 for married. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

Ad Reimbursement Accounts Designed To Empower Confident Spending Savings Decisions. Get a free demo.

American Rescue Plan Act Of 2021 Provisions For Dcap And Cobra

Dependent Care Fsa Limit Increase What Employers Should Know

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Child Care Tax Savings 2021 Curious And Calculated

When To Bump Up Your Fsa Contributions Moneyunder30

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

How A Dependent Care Fsa Can Enhance Your Benefits Package

Special Alert Flexible Spending Account Changes Pro Flex Administrators Llc

Dependent Care Fsa Changes Open Enrollment 2021 Your Richest Life

Child Care Tax Savings 2021 Curious And Calculated

Dependent Care Fsa Flexible Spending Account Ppt Download

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

What Is A Dependent Care Fsa Wex Inc

2021 Changes To Dcfsa Cdctc White Coat Investor

What Is A Dependent Care Fsa Wex Inc

Dependent Care Flexible Spending Accounts Flex Made Easy

Increase In Dependent Care Fsa Under The American Rescue Plan Act Tri Ad

Is The Dependent Care Credit Supposed To Be Negating My Depcare Fsa Bogleheads Org